Specialist Home Insurance

Quality cover for extraordinary homes

Bespoke insurance for high-value homes

Tailored cover for art, antiques, jewellery, and watches

Up to £10,000 for environmental updates when rebuilding

For more information on our Specialist cover, please read the FAQs and policy documents below

John Lewis Specialist Home Insurance

Your high-value home and personal items deserve an insurance service to match. We’ve taken the time to provide bespoke cover with our partner, Covéa Insurance so you can pick a policy that matches your needs.

Our UK-based insurance specialists will personally manage your claims from beginning to end.

Do you need high-value home insurance?

John Lewis Specialist Home Insurance may be right for you if you own:

A listed building or one that was built before 1800

Belongings worth over £40,000 in total or a single item over £20,000

A home with 7 or more bedrooms

A second home or UK holiday home

Prefer to talk?

To speak with our expert underwriters or for any questions, call

Opening hours: Monday to Friday: 9am - 5pm

Calls may be recorded or monitored, and charges will vary.

What’s included in John Lewis Specialist Home Insurance?

Contents

Worldwide cover for your personal items so your valuables can travel with you

Alternative accommodation

If your home is made uninhabitable by an insured event, you’ll get alternative accommodation for up to five years

Rebuild

Claim up to £10,000 for environmental upgrades like solar or wind power when rebuilding your home

Art and antiques

Include art, antiques, jewellery and watches in your policy, to cover your interests and heirlooms

Cyber security

In the event of cybercrime, such as identity theft, cyber security insurance covers you up to £50,000 for connected home devices

Accidental damage

So your dream home isn’t ruined by unexpected mishaps

Home emergency

Support and cover up to £1,500 per claim for sudden emergencies like a burst pipe or broken boiler, available 24/7

Legal expenses

ARAG legal expenses cover, up to £100,000 is available as an optional add-on

An exceptional claims service

If you need to make a high-value home insurance claim, our experts are ready to help.

Our claims service aims to respond to you within two working days and pay approved claims within two working days of settlement. We pay out on 96% of claims within two working days.

(Average claims data for 2024).

For specialist home insurance claims, call

24 hours a day, 7 days a week

For home emergency claims, call

24 hours a day, 7 days a week

Bonus cover features

Specialist cover also provides a few handy extras to protect you against the unexpected and help out if unlikely events happen.

Replacement of a partially damaged item

You can’t always mend broken items, but you can get them restored. John Lewis Specialist Home Insurance covers the cost of replacing damaged or lost art, antiques, or jewellery, even if only partially lost. It also includes restoration costs and any cover for resulting depreciation in value.

Extended replacement cover

If the value of your valuables has increased beyond your schedule, we offer extended replacement cover. Your jewellery, watches, antiques, and art are covered up to 125% for loss, theft, or damage if they’ve been assessed by an accredited valuer within the last five years.

Flood and water leak prevention

Unexpected events like water leaks and floods can happen but early detection can help you get ahead of the damage. If you have an approved claim of over £20,000, we’ll contribute up to £2,500 towards leak detection and prevention devices. Plus, we offer a free LeakBot to help you spot leaks early.

Golf cover

Focus on your golf game with added coverage. If you score a hole-in-one in an official competition, you can claim £500 for celebrations (club secretary authentication required). If your clubs are lost or damaged during play beyond territorial limits, you can claim up to £50 a day (up to £500) for replacement rentals when you collect an invoice.

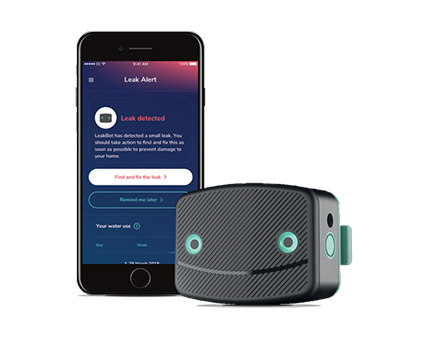

Free LeakBot

Your policy comes with a free LeakBot (worth up to £149). This smart leak detection system is available for new and renewing customers to help identify hidden leaks early.

Simple, quick setup and mobile phone connection

Easy attachment to your cold water pipe without tools

Instant phone alerts at the first sign of a leak

Expert repair from an approved plumber

‘Always on’ monitoring for all leaks

Find out more about LeakBot.

Free LeakBot eligibility excludes flats and maisonettes. View the full terms and conditions here.

Free LeakBot eligibility excludes flats and maisonettes. View the full terms and conditions here.

How do claims work for specialist home insurance?

No claims form to complete

We aim to respond to all queries within two working days

Your own experienced and UK-based claims manager to manage your claim from start to finish

You can choose your own contractor or supplier with our agreement or have us assign one for you

We aim to pay approved claims within two working days of settlement

Policy documents, all in one place

For existing customers please refer to the policy documents sent to you.

Click here to see all policy documents.

Specialist Home policies

Is high-value home insurance right for you?

Everyone has different requirements when it comes to protecting their home and contents. We also offer three levels of flexible home insurance through trusted partner Munich Re.

Frequently asked questions

Does specialist home insurance cover guest houses?

Yes. John Lewis Specialist Home Insurance covers accommodation, like bed and breakfasts, for up to six paying guests. However, it doesn’t cover loss or damage to your home caused by malicious acts, or tenants and paying guests unless force and violence were used to gain entry or exit to the property.

Does specialist home insurance cover guests' contents?

Your John Lewis Specialist policy will include cover for loss or damage to contents in your home belonging to (non-paying) guests for up to £10,000 provided such contents are not otherwise insured. The maximum amount of cover for any single item is £500.

This policy does not apply to malicious acts or to the personal belongings of tenants and paying guests unless force and violence are used to gain entry or exit.

Does specialist home insurance cover flood-risk areas?

As part of the Flood Re initiative, John Lewis Specialist Insurance can provide cover for eligible flood-risk areas and properties that have previously been flooded. We’re proud to help our customers protect their families' safety and well-being against flooding. John Lewis Specialist Home Insurance was one of the first policies to provide Flood Re cover in 2016.

Can I have my rebuild cost calculated for me?

If you haven't had a recent survey, we may provide a valuation at your underwriters’ discretion to ensure that you have the right cover. This will be a desktop valuation and an independent survey of your property conducted remotely using Ordnance Survey data and other tools.

Our partner

Covéa Insurance has been carefully selected to underwrite Specialist Home Insurance from John Lewis.

John Lewis Money, John Lewis Finance, John Lewis Insurance and John Lewis & Partners are all trading names of John Lewis plc.

Covea Insurance plc – our Specialist Home Insurance cover

John Lewis plc is an appointed representative (firm reference number: 416011) of Covea Insurance plc, which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (firm reference number: 202277).

John Lewis Specialist Home Insurance is underwritten by Covea Insurance plc. Registered Office: A & B Mills, Dean Clough, Halifax, HX3 5AX. Registered in England and Wales. Company Number 613259.